All official donation receipts were be mailed on February 25, 2024. You can also access a donation summary in your Online Giving account, click on History, change the year to 2023, and click View.

Log in to Give Online

Thank you for being part of the ministry of Church of the Rock!

You can be confident that each gift that you give, no matter how big or small, goes directly toward our mission of leading people to Christ. Your generosity plays a part in every story of life-change that happens here!

WAYS TO GIVE: Click the subheading below to go to the details for each:

- Online Giving

- eTransfer (Tithes)

- Pre-Authorized Automatic Donations

- In Person

- By Mail

- Gifts of Securities

- Legacy Giving

- Giving to Missions

- Giving to our Television Ministry

Do you have a change of address or change of name? Please use our DONOR UPDATE FORM to provide us the new details.

“Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.”

2 Corinthians 9:7 NIV

What are Tithes and Offerings?

Each week when we are together for our services, we pause to take up an offering – and many give using our app or donating here online in the same way.

As an act of worship, we regularly return to the Lord a portion of our income for the work of His kingdom through our local church. The divine guiding principle for giving, as seen in the Scriptures, is the tithe (ten percent). An offering is what we voluntarily give to the Lord above and beyond the tithe. (You can learn more about this at our Foundations course.)

Regardless of the method or schedule each individual uses to submit their donation, that moment is part of declaring together that our giving is in obedience and thankfulness to God for His overwhelming generosity toward us.

Please note that receiving and spending of funds is confined to approved programs and projects.

Designated Giving Policy:

Each restricted contribution designated toward Church of the Rock approved programs or projects will be used as designated with the understanding that when any given need has been met or cannot be completed for any reason, the remaining restricted contributions will be used where needed most.

Ways to Give

Online Giving – credit card, one time or recurring, view history

Log in to Give

Our online giving portal gives you access to the following features:

- submit individual donations using a credit card

- schedule recurring giving; weekly, bi-weekly, monthly

- view and print contribution history

Questions? Go to ONLINE GIVING FAQ

eTransfer (tithes only) – from your bank account

IMPORTANT: Interac e-transfers are ONLY accepted for TITHE donations.

Log in to your online banking and send an e-transfer to donations@churchoftherock.ca

Please include the following in the message/memo section of your e-transfer, with every donation (space is limited):

- Your FULL NAME with middle name initial

- Your Email address OR phone number

- Your Street Address

- The Campus Code (see list below)); if no campus is indicated, it will be recorded as Winnipeg South

- WSC = Winnipeg South Campus

- BPC = Bronx Park Campus

- NEC = North End Campus

- NVC = Niverville Campus

- OLC = Online Church

- TV = Television Program

Your donation receipt will be issued in the name you provide in the memo/message section. If your name is not included, we may not be able to issue you a donation receipt.

No security question/answer is required; our email is set up with auto-deposit to the church bank account. If you are asked for a security question, double-check the spelling of our email address: donations@churchoftherock.ca.

If you do not have enough space in the memo/message section for your information, please send a separate email with your e-transfer details and the requested information.

NOTE: Financial institutions have different e-transfer processes, some may charge fees or include an option to set up a recurring e-transfer. Please contact your financial institution for more details.

Church of the Rock is not responsible for misdirected donations due to an incorrect email address.

Pre-Authorized Automatic Donations – monthly bank account withdrawal

- Donations automatically withdrawn from your bank account on the 5th of each month.

- To set up a monthly bank account withdrawal, please contact the church office for a permission form.

In Person – cash or cheque at weekend services or church office

Place cash or cheque inside an offering envelope and complete information section. Envelopes can be placed in designated drop slots.

At Guest Services on weekends (also known as the Welcome Centre) or at the church office (weekdays) you can access a payment terminal to process a debit or credit card transaction.

By Mail – cheque or money order

If you wish to send a cheque in the mail, please write your cheque to: “Church of the Rock” and be sure that we are also receiving your full name and address for tax receipting purposes.

Our mailing address is:

Church of the Rock

1397 Buffalo Place

Winnipeg MB R3T 1L6

Gifts of Securities – donation of stocks or mutual funds

Donating stocks or mutual funds is the most effective way to maximize your tax savings. When transferring shares (shares, bonds, mutual funds) directly to a registered charity, such as Church of the Rock, the capital gains do not need to be reported as income and are therefore not taxable.

In addition, a donation receipt is issued for the full value of the shares, further reducing income taxes.

- Contact your Financial Advisor and advise him/her of the transfer.

- Go to one of the suggested brokers to facilitate the transfer of shares to a charity.

- Upon receipt of the shares, the broker will redeem the shares and provide a donation receipt to the donor for the value at the time of transfer.

- Church of the Rock will then receive a cheque for the donation

Suggested Brokers

- Canadian Centre for Christian Charities (CCCC) Community Trust Fund

- Abundance Canada

- Canada Helps

This can be an efficient way to give your yearly tithe.

If you would like more info or to make a gift of listed securities (shares), please contact our Financial Manager (204-261-0070).

Legacy Giving – planned gifts and estate planning

When you make the decision to leave a Planned Gift to Church of the Rock, you will help assure the continual financial health of the church and its programs. There are several ways you can provide a planned gift:

- Bequests through a will

- Life insurance

- RRSPs & RRIFs

- Gifts of securities.

Estate Planning

You can name Church of the Rock as a beneficiary in your will, insurance policy or RRSP/RRIF. Leaving a gift to a registered charitable organization can help to reduce the tax that your estate will pay while also leaving a legacy of faith that will continue to support God’s work.

Giving to Missions

Missions are an integral part of the vision of Church of the Rock to help people Know God, Live Free, and Find Purpose. We support many local, national, and international mission outreaches by partnering with other faith based charities and through our own projects.

How to support missions

- General Missions – used to support our regular monthly commitments.

- Specific Projects – international mission projects and trips – e.g. “10/40 Window & Beyond” (Pie Auction)

ONLINE GIVING

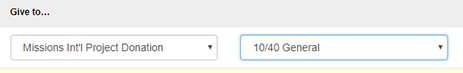

Once inside Online Giving, under “Give to…” select “Missions Int’l Project Donation” and then the specific project.

e.g.

Log in to Give

OTHER

Include note on offering envelope or with other donations (eTransfer donations are accepted for tithes only).

Giving to Television Ministry

The Church of the Rock television program is seen coast to coast in Canada. You’ll notice we never ask for money on air but trust God for His provision. Thank-you for being part of this outreach to our nation!

ONLINE GIVING

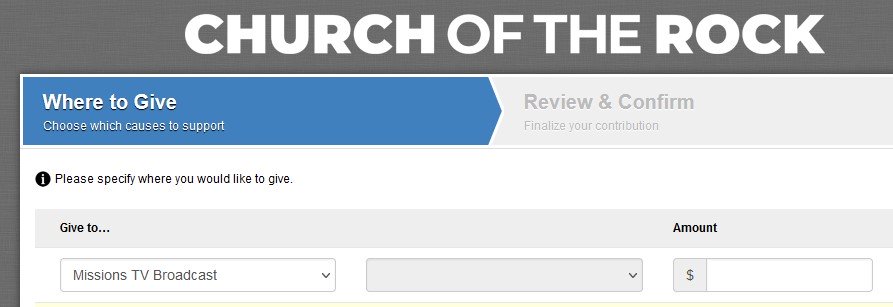

Once inside Online Giving, under “Give to…” select “Missions TV Broadcast”

e.g.

Log in to Give

OTHER

Include note on offering envelope or with other donations (NOTE: eTransfer donations are accepted for tithes only).

Recent Comments